Invoices

You can use the Invoices API to obtain details of your bol invoices. This allows you to:

-

Get an overview of your bol income and costs over a certain period.

-

Administer your bookkeeping.

The Invoices API does not import any details of your orders. For more information about those, see Orders and shipments.

How does invoicing work at bol?

bol regularly issues a set of invoices to its partners, depending on their configuration and requirements:

-

A retailer invoice is sent out at the end of every month, except to certain partners who receive it twice a month. On this invoice we bundle the retailer’s income and costs for the period to calculate the net-payout for the period (excluding Avb costs, see below). All the retailer’s sales from the period are added together and their costs, such as commission and shipping labels, are subtracted. Please refer to the invoice type line table below for all the different line items that could be included on a retailer invoice.

-

The Avb invoice is only applicable to partners who utilize the advertising services of bol. This invoice relates to the services provided by Advertising via bol, which primarily engages in marketing and advertising activities.

By examining the invoiceType field, which can take one of the following values, you can distinguish these two invoices apart:

-

ALL_IN_ONE- Specifies the retailer’s invoice. -

ADVERTISING_VIA_BOL- Specifies the Avb invoice.

From v9 of the Retailer API onward, the invoice type BOL_RETAIL_MEDIA_GROUP (BRMG) is renamed to ADVERTISING_VIA_BOL (Avb).

|

Settlement

If the amount to be received by the retailer as per the retailer invoice is higher than the amount to be paid, the to-be-paid invoice is settled against the to-be-received invoice. This amount can also be seen in the payableAmount field, which is owed by the retailer if the amount is positive, and owed to the retailer if the amount is negative. If the amount to be received is lower than the amount to be paid, the retailer needs to pay the invoice separately. Please note, no settlement will be done if the to-be-paid amount is higher than the to-be-received amount.

Invoices API

The demo endpoints show an example of the fields you would receive back from an invoice request.

The following endpoints are available for invoicing:

Field mapping for invoices

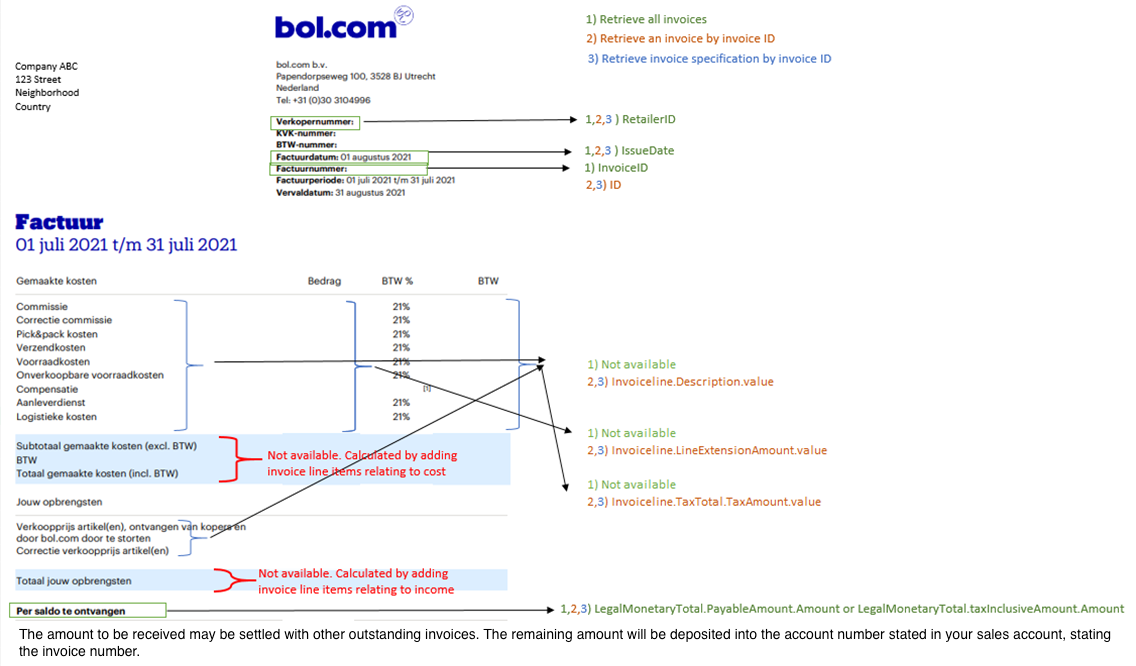

This image shows how the fields in bol invoices are used by the various endpoints.

Retrieving all invoices

Returns a minimal summary of all invoices in a defined period of time. The default time is 4 weeks and the maximum is 32 days. This summary is a list and follows our pagination standards.

The following information is returned about every invoice:

-

Invoice ID

-

Issue date

-

Invoice type

-

Currency ID

-

Amount excluding VAT

-

Amount including VAT

-

Invoice media types

Retrieving an invoice by invoice id

Using the invoices-id from Get all invoices, you can obtain a single detailed invoice. You can request this either in PDF - in which case it will be the same as the invoice from CashBoard - or in HTML/JSON format, in which case it will be sent in SI-UBL 2.1 format. This format is described on at http://docs.oasis-open.org/ubl/UBL-2.1.html.

The invoices contain detailed information such as:

-

Information about bol and the retailer: Information such as the company name, address, KvK number, VAT scheme, and contact number.

-

Invoice totals: The total of the invoice, both including and excluding VAT.

-

Details about individual line items: The aggregated details of each type of retailer transaction is provided. This includes information such as the total amount (both including and excluding VAT) and a description of the line item. For a full specification of the different invoice line item types, please refer to the Invoice line details. Examples of line items include:

-

Turnover

-

Commission

-

Packaging costs

-

Delivery costs

-

Retrieving an invoice specification by invoice id

Use the Get an invoice specification by invoice id endpoint to retrieve an invoice specification with a paginated list of transactions. It retrieves the details of the retailer and Avb invoices through the invoices-id. It provides details of all the transactions within an invoice in the JSON or Excel format for up to 2 years in the past.

The invoice specification can be classified into the following categories:

-

dealType- Specifies a mandatory reference type for each transaction within the invoice specification.The supported

dealTypereferences are mentioned below:Table 1. Supported deal type references Type of invoice Supported deal type references Avb Invoices

-

Campagnenaam

Retailer Invoices

-

Bestelnummer -

Track and Trace -

Product titel -

Collectie referentie -

Paklijst referentie -

Casenummer -

Toelichting

For example, if an order has been shipped through the

VvBservice, the invoice specification will exhibit the following transactions detailing the financial break-up of the order:-

TURNOVER -

COMMISSION -

DISTRIBUTION_BY_BOLCOM_LABEL

In this case, the

dealTypefor theTURNOVERandCOMMISSIONtransaction will be theBestelnummer. ThedealTypeof theDISTRIBUTION_BY_BOLCOM_LABELtransaction will be theTrack and Trace. -

-

dealDetailsType- Specifies an optional reference type that provides a deeper level of categorization for the transactions in the invoice specification.The supported

dealDetailsTypereferences are mentioned below:Table 2. Supported deal details type references Type of invoice Supported deal details type references Avb Invoices

-

ON-number

Retailer Invoices

-

EAN

In the aforementioned example,

dealDetailsTypefor theTURNOVERandCOMMISSIONtransaction will be theEAN. TheDISTRIBUTION_BY_BOLCOM_LABELtransaction will have nodealDetailsTypeavailable since the only supporteddealDetailsType,EANis not applicable to the transaction. -

An invoice specification details the following information for each of its transaction:

| Property Name | Field name | Category | Description |

|---|---|---|---|

Invoice number |

|

N/A |

Specifies the transactions belonging to a certain invoice line. For example, all NOTE: The invoice number and the description are split with a # symbol. |

Order ID |

|

|

Specifies the order number linked to the transaction. NOTE: Applicable only for order related transactions. For example, |

Description of transaction |

|

N/A |

Specifies the transaction type in Dutch. |

Track and Trace number |

|

|

Specifies the track and trace number. NOTE: Applicable only for logistic services. For example, all shipment label transactions such as |

Product title |

|

|

Specifies the product title used to list the product on the bol. NOTE: Applicable only for inbounds and stock services. |

Collection reference |

|

|

Specifies the collection reference linked to the transaction. NOTE: Applicable only when |

Delivery ID |

|

|

Specifies the delivery ID linked to the transaction. NOTE: Applicable only for first mile services. |

Case number |

|

|

Specifies the case number linked to the transaction. NOTE: Applicable only for compensations. |

Remark |

|

|

Specifies the remark mentioned in the transaction. NOTE: Applicable only for manual corrections. |

EAN of product sold |

|

|

Specifies the EAN number linked to the transaction. NOTE: Applicable only for costs charged on a product level. |

Campaign name (Avb) |

|

|

Specifies the actual campaign name in which the advertising costs were incurred. Available for all advertising transactions. NOTE: Applicable only for Avb invoices. |

|

|

Specifies which transactions belong to which display campaigns. NOTE: Applicable only for Avb invoices. |

|

Quantity |

|

N/A |

Specifies the invoiced quantity in the transaction. |

Price |

|

N/A |

Specifies the total price excluding VAT. |

VAT amount |

|

N/A |

Specifies the total price including VAT. |

The properties belonging to dealType category will not be reflected in all transactions.

|

Invoice line details

The following are the types of line items you can see on an invoice:

Avb invoice

| Invoice line type | Explanation |

|---|---|

|

Costs for sponsored products on the bol website. |

|

Cost correction for sponsored products on the bol website. |

|

Discounts on costs for sponsored products on the bol website. |

|

Costs to include advertisements in an online magazine. |

|

Cost corrections to include advertisements in an online magazine. |

|

Discounts on costs relating to advertisements in an online magazine. |

|

Costs to include a daily offer on the website. |

|

Corrections of costs to include a daily offer on the website. |

|

Discounts on costs to include a daily offer on the website. |

|

Costs for a banner on the bol website. |

|

Correction for costs for a banner on the bol website. |

|

Discounts on costs for a banner on the bol website. |

|

Costs for a banner on a third party’s website. |

|

Correction for costs for a banner on a third party’s website. |

|

Discounts on costs for a banner on a third party’s website. |

|

Costs for advertising on social media. |

|

Correction of costs for advertising on social media. |

|

Discounts on costs for advertising on social media. |

|

Costs for a specific promotion. |

|

Correction of costs for a specific promotion. |

|

Discounts on costs for a specific promotion |

|

Costs for a specific promotion. |

|

Correction of costs for a specific promotion. |

|

Discounts on costs for a specific promotion. |

Retailer invoice

| Invoice line type | Explanation |

|---|---|

|

Commission for an article sold and shipped. |

|

Correction of initially charged commission. |

|

Compensation. |

|

Compensation for lost items. |

|

Costs for pick-up of inventory into the bol warehouse (FBB). |

|

Correction of initially charged first mile costs (FBB). |

|

Costs for either: labeling incoming inventory, orders to destroy inventory, or sending back unsellable inventory (FBB). |

|

Costs for not-saleable-inventory (FBB). |

|

Costs for an FBB shipment. |

|

Correction of initially charged outbound. |

|

Picking & packing costs (FBB). |

|

Correction on initially charged pick & packing costs (FBB). |

|

Costs for a return label. |

|

Correction of initially charged return labels. |

|

Costs for authorization of brands. |

|

Correction of initially charged retailer authorization. |

|

Costs for a shipping label. |

|

Correction of initially charged shipment labels. |

|

Costs for a shipping label from PostNL. PostNL is VAT-exempt and all other transporters have the standard high Tax rate. |

|

Correction of initially charged PostNL labels. |

|

Costs that are made for your inventory (FBB). |

|

Price of the item you sold and shipped. |

|

Correction on turnover in case of a return. |

|

This can be due to a wide variety of reasons. Some possible examples are: NCO (Non Commercial Order), URO (Unsellable Return Order), bSKU labelling, or stock corrections. |

(*) This invoice line is not used anymore today but may still appear in older invoices.